Image Result For How To Build Your Credit At A Young Age

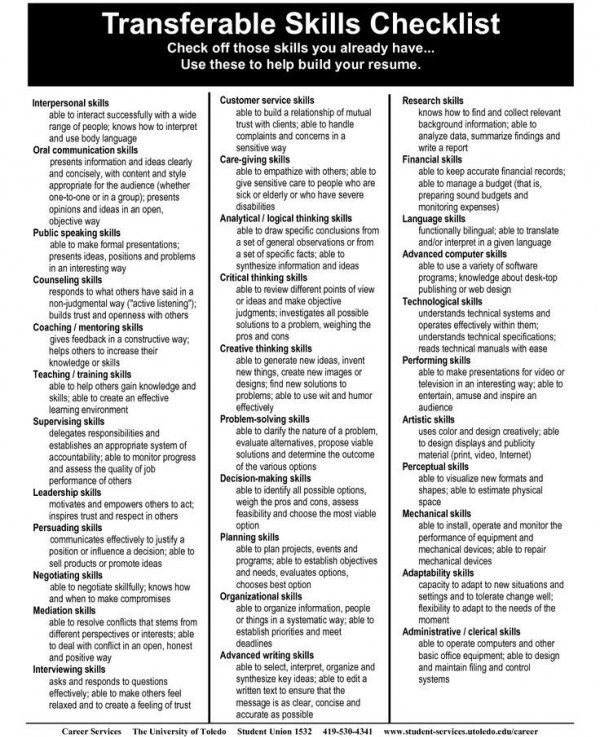

Ways to Start Building Credit at a Young Age. Become an Authorized User on Your Parent s Card. The most straightforward way to build your credit is by taking out a credit card and paying it down each month. Use a Secured Credit Card to Stay Within Your Means. Apply for a Store Card. Use Your Rent Payments to Build .Credit Tips for All Ages. Establish and maintain a credit history. Pay your bills on time. Establish good credit while you are young. Open a credit card account, and use it wisely. Take out an installment loan. Have someone cosign if necessary. Demonstrate stability. Plan ahead for major credit purchases..Use your credit card only for items that you can afford. If you use your credit card to purchase things you can t afford, you ll have . Savvy Ways to Build Your Credit at a Young Age. Open a Secured Credit Card Account. While it s a little ironic that you need credit to get credit, a good place to start is a secured credit card. Move on to Traditional Credit Cards. Get Utilities or Phone Service in Your Name. Get Some Help from the Parents. Pay Your . Learn the best ways to build credit quickly without going into debt. others who started building credit in their early twentiesor even younger. That s because the average age of your credit accounts is one scoring factor..Building good credit is a must It will help you qualify for loans, auto insurance, rental In the wake of the Credit CARD Act, people under the age of now must have a credit scores for no file people, which includes lots of young people..

Related posts to How To Build Your Credit At A Young Age

How To Build Credit The Right Way Money Under

No Annual Fee, cash back on every purchase, and helps you build your credit with responsible use. Your Secured Credit Card requires a refundable security deposit up to the amount we can approve of at least $ which will establish your credit line..

Credit Trends By Age Credit Karma

Based on our data, there is a clear relationship between age and average credit scores. Generally speaking, younger consumers have lower credit scores on average..

Everything You Need To Know To Improve Your Credit History

Figuring out how to improve your credit score can feel daunting, mostly because getting those numbers to go up can really be a process. While there are a few things you can do to raise your credit scores in the short term, there are factors of your credit that, well, just take time..

Tips To Help Your Teen Build Credit Experian

Today's teens have robust social media profiles, engaging heavily with Instagram, Snapchat and YouTube. If Gen Z'ersindividuals born between want to succeed in the real world too, they must know how to establish and manage credit..

Image Result For How To Build

Image Result For How To Build

Image Result For How To Build

Image Result For How To Build

EmoticonEmoticon